Wine Investing 101: How To Invest In Wine Like A Pro

Wine, apart from being a status symbol and a luxury item, is also a financial asset that can grow in value over time. That is why wine investing has become increasingly popular in recent decades.

Wine, apart from being a status symbol and a luxury item, is also a financial asset that can grow in value over time. That is why wine investing has become increasingly popular in recent decades. Collectors and investors alike seeking to benefit from the rise of the global wine market of fine wines.

We came to appreciate fine wine investment possibilities not just as sommeliers, but as professionals who’ve seen firsthand the potential that lies hidden in some of the wines we enjoy and cherish deeply. However, investing in wine is not as simple as buying a few already well-priced bottles and waiting for them to grow in value. There are several important factors to consider before becoming an investor.

This article aims to guide you through the process of starting to plan your wine investment and smartly build your wealth! We`ll explain everything related to this topic in greater detail, sharing everything we’ve learned in a step-by-step manner.

How To Invest In Wine: Step-by-Step Guide

Just like any other type of investment, wine requires strategy, research, and a bit of patience. If you are interested in investing in wine, the first step is to research and educate yourself on the market. Attend tastings and events, communicate with industry professionals, read industry publications, and talk to other collectors and investors to get a better understanding of the market. Once you have a better understanding of the market, it is important to establish a budget for investing in wine. Building a wine collection requires patience, knowledge, and a significant budget. This will help you to set realistic goals and make informed investment decisions.

When purchasing wine, always buy from reputable sources and establish a clear chain of custody. The wine you are purchasing needs to be of high quality and stored properly. It is important to establish a clear strategy for your collection.

A great place to start is with a few high-quality bottles from well-established regions such as Bordeaux, Burgundy, and Southern Rhône or a vintage bottle from some of the most esteemed Champagne brands. Over time, you can add to your collection and diversify your holdings with different regions and producers. It is also important to have a plan for storing and caring for your collection. This means investing in proper storage units, wine cellars, or multi-zone wine fridges for a start, temperature control systems, and insurance to protect your investment. Here’s a step-by-step detailed guide to help you get started on the right foot.

Define Your Goals and Budget

Before you buy your first investment-grade bottle, ask yourself why you’re investing in wine. Is it purely for financial gain? Or is it a mix of passion and profit? Your goals will shape your investment strategy. For instance, if you’re in it for the long haul, focus on wines that improve with age and have strong long-term value potential. You don’t need to be a millionaire to invest in wine, but it’s fair to say that higher-end, sought-after wines tend to perform better. Starting small is perfectly fine – we always suggest to new investors that it’s better to build slowly and intelligently than to dive in over your head.

Practical Tip: Allocate no more than 5-10% of your total investment portfolio to wine. This ensures that your collection is a complement to your other investments rather than a high-risk, all-in-play.

Research: Learn the Market Like a Sommelier

Photo credit: Château La Nerthe from Chateauneuf-Du-Pape by Provence and Wine

The key to successful wine investing is knowledge. In the same way that a sommelier studies wine regions, producers, and vintages, you’ll need to do your homework. The fine wine market is nuanced, and understanding which wines are worth investing in takes time.

Start by focusing on well-established wine-producing regions known for creating investment-grade wines. Bordeaux and Burgundy, or Southern Rhône in France are the most recognized, with their top estates producing some of the most valuable wines. But don’t overlook other regions like Italy’s Piedmont (Barolo) and Tuscany (Super Tuscans), Spain’s Ribera del Duero and Rioja, Portugal (Alentejo or Douro), or even some standout producers from California (Napa Valley), Australia (Barossa Valley), and South America (for example Mendoza from Argentina or Maipo Valley from Chile).

The next step is to look at vintages. Not every year is a good year for every region. A wine’s vintage plays a critical role in its potential to appreciate in value. For instance, Bordeaux’s 1990, 2005, 2009, 1945, and 1961 are exceptional vintages. Other remarkable Bordeaux vintages include 1985, 1986, 1989, 1996, 1998, and 2000. Burgundy’s 2015 on the other hand was frequently likened to the outstanding vintages of 2002, 2005, and 2010.

Champagne had outstanding vintages in 2000 and 2002, but the years 1928, 1929, 1945, 1955, 1990, and 1996 are widely regarded as the best of all, known as millennium vintages. Other outstanding vintages come from 2012, 2013, and 2014. The latter half of the decade produced some excellent results in Champagne, with notable vintages including 1995, 1996, 1997, 1998, and 1999. In the 1980s, the top vintages include 1982, 1985, 1988, and 1989.

In addition to vintage, focus on producers with a proven track record of creating wines that age well. Some producers are consistent performers, with their wines regularly commanding high prices on the secondary market.

Here is a more detailed information table, categorized by countries, wine regions, renowned estates and producers, best vintages, and one of their most expensive wines:

| Country | Wine Region | Famed Estates | Best Vintages | Most Expensive Wines |

|---|---|---|---|---|

| France | Bordeaux | Château Lafite Rothschild, Château Margaux, Château Latour | 1945, 1961, 1985, 1986, 1989, 1990, 1996, 1998, 2000, 2005 and 2009 | Château Lafite Rothschild, Château Petrus |

| Burgundy | Domaine de la Romanée-Conti, Domaine Leroy, Domaine Leflaive | 1990, 1999, 2002, 2005, 2010, 2015 | Domaine de la Romanée-Conti La Tâche, Vosne-Romanee Cros Parantoux | |

| Southern Rhône | Domaine Jean-Louis Chave, Château de Beaucastel | 1929, 1947, 1961, 1998, 1990, 2000, 2001, 2005, 2009, 2007, 2009, 2010, 2012, 2015 | Jean-Louis Chave Hermitage | |

| Italy | Piedmont (Barolo) | Giacomo Conterno, Gaja, Bruno Giacosa | 1961, 1964, 1970, 1971, 1978, 1982, 1985, 1989, 1990, 1996, 2001, 2004, 2005, 2008, 2010, 2013, 2013, 2016 and 2019 | Giacomo Conterno Monfortino, Gaja Sori Tildin Langhe |

| Tuscany (Super Tuscans) | Sassicaia, Tignanello, Ornellaia | 1985, 1997, 2004, 2006, 2010, 2013, 2015, 2016, 2019 | Tenuta San Guido Sassicaia, Tenuta Tignanello | |

| Spain | Rioja, Ribera del Duero | Vega Sicilia, La Rioja Alta, López de Heredia | 1994, 2001, 2004, 2010, 2016 | Vega Sicilia Único |

| Portugal | Douro, Alentejo | Niepoort, Quinta do Noval, Herdade do Esporão, Herdade do Rocim | 2000, 2003, 2011, 2017 | Jupiter Code 01 |

| USA | Napa Valley (California) | Screaming Eagle, Harlan Estate, Opus One | 1997, 2002, 2005, 2013, 2016 | Screaming Eagle Cabernet Sauvignon |

| Australia | Barossa Valley | Penfolds, Henschke, Torbreck | 1990, 1998, 2004, 2010, 2012 | Penfolds Grange, Penfolds Block 42 |

| South America | Mendoza (Argentina), Maipo Valley (Chile) | Catena Zapata, Viña Concha y Toro, Almaviva | 2001, 2004, 2010, 2015, 2016 | Catena Zapata Adrianna Vineyard Malbec, Catena Zapata Estiba Reservada |

This table highlights key countries, regions, top estates, best vintages for investment, and some of the most expensive wines in the world.

Practical Tip: Subscribe to wine publications like Wine Advocate, Wine Spectator, or Decanter to stay updated on the latest market trends and vintage reports. Keeping your ear to the ground is key in this business. PS: Check out our article on future trends in the wine industry to stay ahead.

Invest in What You Know and Love

This is one of the most important pieces of advice we can offer. If you’re knowledgeable about certain regions or producers, start there. Wine investing is about more than just numbers – it’s about personal connection. You’re more likely to make informed decisions when you invest in wines you truly care about.

Our own experience? We started investing in Bordeaux because it’s a region we love and have studied extensively. Our passion, knowledge and connections gave us the patience and curiosity needed to research producers, compare vintages, and learn the market dynamics over time. Passion helps you navigate the inevitable ups and downs of the market.

Of course, diversification is key. Over time, as you become more comfortable, you can broaden your horizons and explore different regions or styles of wine. A diversified wine portfolio will help mitigate risk.

Buy the Right Wines: Investment-Grade Criteria

Now that you have a strategy in place, how do you know which wines to buy? Not all wines are created equal, and most wines you see at many nowadays wine shops won’t appreciate in value over time. Investment-grade wines share certain characteristics:

- Provenance: The wine’s production (or producers!) history and where it’s been stored is crucial. Provenance affects both the value and authenticity of a wine. Wines that have been stored properly, in the right conditions (ideally in professional storage), are more likely to maintain their value. Keep all paperwork, invoices, and certifications that come with the wine.

- Track Record: Focus on wines from producers with a strong track record of increasing in value. Think of it as a company with consistent performance. Some estates have built reputations over centuries, and their wines are safe bets.

- Longevity: Only certain wines improve with age. Look for wines that have the structure (acidity, tannin, and balance) to age for decades. Some of the top-priced last-year vintages will develop beautifully over 20, 30, or even 50 years, gaining in value.

- Critical Acclaim: Wines with high scores from respected critics (such as Robert Parker, Jancis Robinson, James Suckling or Antonio Galloni) tend to perform better. Scores of 95+ can boost a wine’s market value significantly, but be wary of chasing scores alone – the market can be fickle and it always comes down to customer preferences and wine trends.

- Scarcity: Wines produced in small quantities tend to command higher prices, especially if they come from highly regarded vintages or producers. Limited production creates a natural supply constraint, which can drive up demand (and prices!) over time.

Understand the Costs

There’s more to wine investing than simply buying bottles and watching their value grow. There are several costs to factor in, so make sure you have a clear picture before you start building your collection.

- Storage: Fine wine needs to be stored under specific conditions – temperature, humidity, vibration disturbance, low-quality corks, bottle positioning, and light can all affect the quality of the wine. Most serious investors use professional wine storage services, which can cost anywhere from $10 to $30 per case per year. This isn’t optional – improper storage can ruin your wine and its investment potential.

- Insurance: Like any valuable asset, wine should be insured. Specialized wine insurance policies will protect your collection from damage, theft, or loss. The cost of insurance is typically 0.5% to 1% of the wine’s total value per year.

- Transaction Fees: When it’s time to sell, you’ll likely face fees, whether you’re selling through an auction house, wine exchange, or broker. These fees can range from 5% to 15% of the sale price, so be sure to factor them into your investment strategy.

- Buyer’s Premium: If you’re buying at auction, there’s usually a buyer’s premium (often 10-20%) added to the final hammer price. This can significantly increase the cost of your wine, so always be aware of these additional charges.

Know Where to Buy and Sell

When you’re ready to make your first investment, where should you go to buy fine wine? There are several options, each with its pros and cons.

- Wine Merchants: Established fine wine merchants (like Berry Bros. & Rudd or Sotheby’s Wine) are trusted sources for investment-grade wines. They often offer wines with clear provenance and storage history.

- Wine Exchanges: Platforms like Liv-ex (the London International Vintners Exchange) allow you to buy and sell wine on a global marketplace. Liv-ex is a great tool for tracking market prices and trends, offering a transparent, data-driven approach to wine investing.

- Auctions: Major auction houses like Christie’s, Sotheby’s, and Bonhams often hold fine wine auctions. Auctions can be a great way to acquire rare and valuable bottles, but they require careful research and a clear understanding of the market.

- Direct from the Producer: Some producers offer the opportunity to buy wine directly from their estates, especially with futures (en primeur). This allows you to purchase wine before it’s even bottled, often at a lower price than when it hits the market later.

When it’s time to sell, you can use the same platforms, but remember to factor in transaction fees and market conditions. Timing is everything – selling too early can limit your returns, while waiting too long may cause you to miss the peak of the market.

Stay Patient and Play the Long Game

While wine investing can be lucrative, it is important to remember that it is a long-term investment. Wine needs time to appreciate in value, and you may not see a return on your investment for several years. Additionally, investing in wine requires a significant amount of knowledge and research. As we mentioned, it is essential to understand the different regions, vintages, and producers in order to make informed investment decisions.

Wine investing is not a get-rich-quick scheme. Fine wine typically appreciates over time, and the most successful investors take a long-term approach. We recommend holding your wines for at least 5-10 years before considering selling. Some wines can take decades to reach their full potential, and the longer you hold onto them (assuming they age well), the higher the potential reward.

But don’t forget to monitor the market regularly. Keep an eye on prices, vintages, and trends. Staying informed will help you make strategic decisions about when to buy more, when to hold, and when to sell.

Understand the Risks

As with any investment, there are risks and rewards associated with wine investing. The rewards can be significant, with high returns possible over the long term. However, wine investing is not without its risks. Fluctuations in the market, changes in consumer preferences, even weather-related events (which can affect harvests and supply), and the potential for fraud are all factors to consider before investing.

Although fine wine has historically offered solid returns, the market is not immune to downturns, and it is essential to have a long-term strategy when investing in wine. This means purchasing wine with the intention of holding onto it for several years or even decades. It is also important to remember that wine does not always appreciate in value and there is no guarantee that you will see a return on your investment.

Counterfeiting (does Sour Grapes doc story ring a bell!) is a great risk to be aware of, particularly with older, more valuable bottles. Always buy from reputable sources and ensure that provenance and authenticity are properly documented.

Lastly, it’s worth mentioning that wine is an illiquid asset (pun intended). Unlike stocks or bonds, you can’t easily sell wine at the click of a button. It may take time to find the right buyer, especially if you’re selling rare or niche bottles.

Why Invest in Wine?

For centuries, fine wine has been viewed as a luxury item, and its reputation as a store of value has grown in recent years, especially as people look for ways to diversify their portfolios. According to the Liv-ex Fine Wine 100 index, the top 100 most sought-after wines in the world have appreciated in value by over 200% in the past 10 years. This is a significant increase and shows the potential for investors to achieve high returns in the wine market. Here are a few reasons why wine has become a popular investment:

- Limited Supply, Growing Demand: Fine wine is a finite resource. Once a bottle is consumed, it’s gone forever. As time passes, the best vintages from renowned regions become rarer, increasing their value. Simultaneously, global demand for fine wine, especially from emerging markets like China, has steadily risen.

- Stable Returns: Historically, fine wine has shown consistent returns, often outperforming more traditional investments like stocks or bonds, particularly in times of economic uncertainty. Wine isn’t immune to market fluctuations, but it’s less volatile than many other assets.

- Low Correlation with Traditional Markets: Fine wine’s value isn’t closely tied to stock markets or geopolitical events, which can make it an appealing option when looking to hedge against market downturns. If your stock portfolio is taking a hit, your wine collection might still be appreciating.

- Tax Benefits: In some countries, wine is considered a “wasting asset” (because it has a lifespan), and it can be exempt from capital gains tax. But this varies by jurisdiction, so always check local tax laws before diving in.

- Enjoyment Factor: Let’s be honest – wine investing comes with a unique perk. You can enjoy your investment. There’s no other asset class that you can share at dinner with friends and family, and even if the market doesn’t go the way you expect, at least you’ll have some fantastic bottles to drink.

Is Wine a Good Investment?

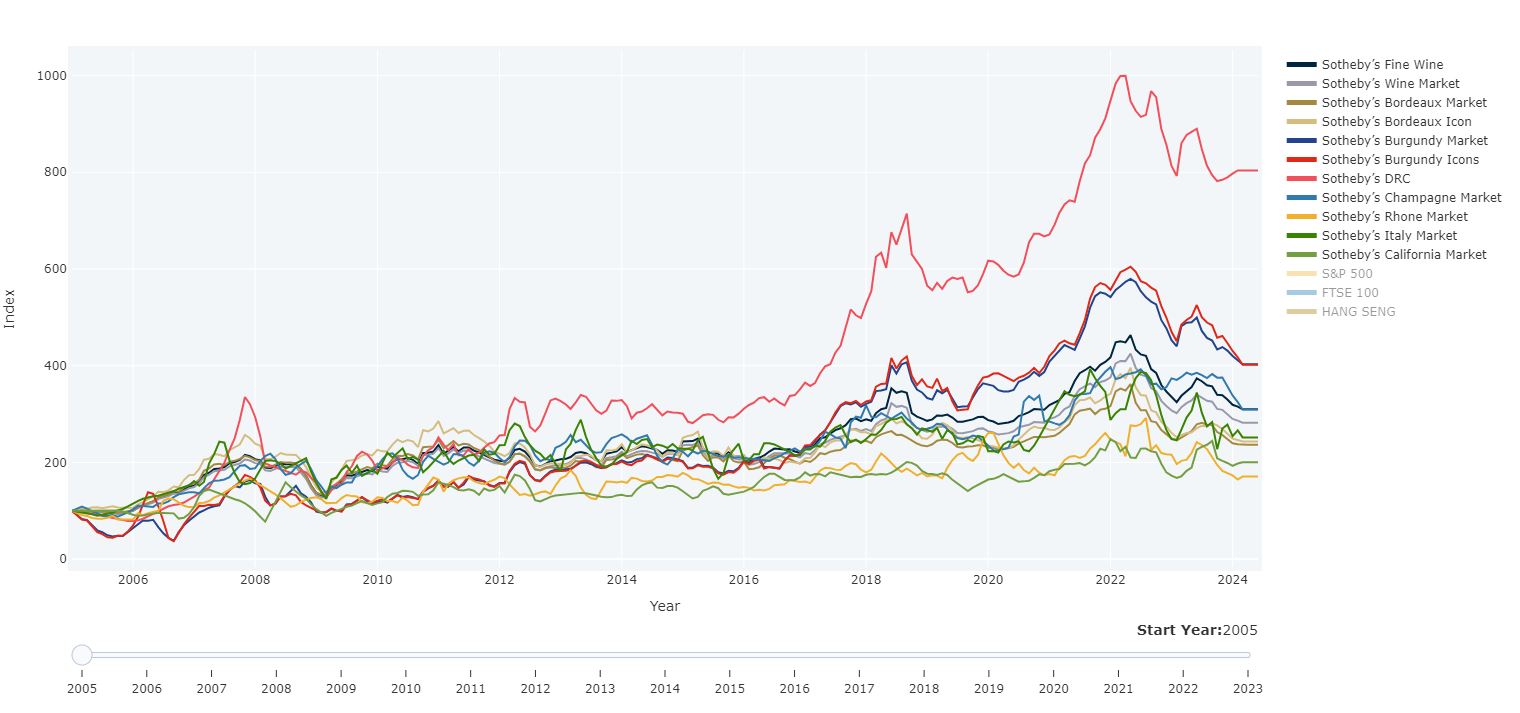

Photo credit: Sotheby`s Mei Mosses Wine Index covering the data, value, and investment grade of fine wines from 2005 to June 2024

The short answer is yes, wine is a good investment—but like any investment, it comes with its own risks, rewards, and nuances. If you’re already familiar with investing in things like stocks, bonds, or mutual funds, you’ll know about the value of diversification. Well, wine offers a unique kind of diversification, one that’s less tied to traditional financial markets. That means, when stocks are down, your wine investments might still be growing.

Wine is an asset class that doesn’t exactly follow the typical cycles of the economy. It’s driven by different factors altogether—like vintage quality, production levels, and market demand. Wine is not impacted by things like corporate earnings or interest rates. Instead, it’s affected by nature, by how good the growing and harvest season was, by aging potential and producer brand, and by trends in consumer preferences. All of these elements create a unique dynamic where wine can be a great counterbalance to your more traditional investments.

When it comes to investing, your stock portfolio may be influenced by political changes and economic predictions. For instance, major market events like the 2008 financial crisis and the coronavirus pandemic have significantly impacted stock investments. However, during such periods, investments in fine wine have shown to be relatively unaffected by the overall economic conditions. If you are looking to create a well-rounded investment portfolio, it’s important to consider including wine as part of your investment strategy.

Why Wine is Growing as an Asset Class

Wine isn’t just for drinking anymore. It’s becoming a serious financial asset, and the numbers back it up. According to Vantage Market Research, the global wine market is on track to grow from $441.6 billion in 2022 to a whopping $698.5 billion by 2030. That’s an annual growth rate of about 5.9%, which is pretty solid. In the U.S. alone, wine sales hit $78.4 billion in 2021. That’s a big market, and it’s only getting bigger.

Even if you’re not a hardcore collector or investor, those figures are hard to ignore. More people than ever are recognizing the value of fine wine, not just for its enjoyment, but for its financial upside. When you look at the performance of fine wine compared to other luxury assets, it’s actually outpacing many of them. For example, over a 10-year period, wine appreciated in value by 146%. Compare that to other collectibles like art (105%) or jewelry (37%), and you can see why wine is catching attention as a smart investment choice.

What Makes Wine a Valuable Investment?

So, what is it that makes wine such a valuable asset? Why do certain bottles skyrocket in price while others remain relatively affordable? It comes down to a few key factors.

First, there’s scarcity. When you buy a wine like the 2004 Monfortino, for example, that’s it. No more bottles of that vintage will ever be produced. As time goes on and more people drink those bottles, the remaining stock becomes rarer and rarer, and that scarcity drives up the price. Every time a bottle is opened, the value of the remaining bottles increases. It’s simple supply and demand, but in a very specialized market.

Another important factor is quality. Not all wines are investment-worthy. If you’re serious about this, you need to understand what makes a wine age well and increase in value. Generally, higher-tannin red wines are the go-to. Wines from regions like Bordeaux, Rhône, Napa Valley, or Barolo tend to be good bets for long-term value. These are regions known for producing wines that age gracefully and develop complexity over time. You want wines with structure, balance, and the ability to evolve as they mature.

But it’s not just about red wines. High-alcohol dessert wines like Germany’s Trockenbeerenauslese, French Sauternes, and certain Austrian wines can also appreciate over time. Even top-tier Champagne has investment potential, especially if stored properly. These wines, often considered “trophy wines,” can maintain or even grow in value, especially when they’re well-cellared.

How to Choose Investment-Grade Wines

Now, I know you’re probably thinking, “Okay, but how do I choose the right wines to invest in?” Here’s where things get interesting.

As a general rule, you want to stick with reds that have high tannin levels. Tannins act as a natural preservative, meaning these wines have the structure to age well over decades. Wines from Bordeaux are often considered the gold standard, but regions like Barolo and Napa Valley are also worth exploring. Burgundy can be a bit trickier—while it’s prestigious, it doesn’t always age as well as some of the higher-structure wines from other regions.

For those looking to diversify a bit within the wine world, don’t overlook dessert wines and Champagne. While red wines tend to dominate the investment scene, dessert wines with higher alcohol content, like Sauternes or Eiswein, can also hold their value over time. And a well-stored bottle of prestigious Champagne can become a true collector’s item.

One more crucial piece of advice: storage matters. You could have the rarest, most valuable wine in the world, but if it’s not stored properly, its value will plummet. Wine needs to be kept in the right conditions to age gracefully—cool temperatures (ideally around 55 degrees Fahrenheit for reds), consistent humidity, and protection from light are key. If you don’t have a proper wine cellar at home, there are plenty of professional storage facilities that specialize in preserving investment-grade wine. It’s worth the investment to ensure your bottles stay in pristine condition.

How Wine Compares to Other Investments

If you’re still wondering how wine stacks up against other investments, let me give you some numbers. According to Knight Frank’s Luxury Investment Index, wine outperformed many other collectibles over the last decade. While fine wine saw a 146% price increase, assets like art, watches, and jewelry appreciated by 105%, 138%, and 37%, respectively. Even more impressively, wine has outperformed both real estate and gold in terms of stability and growth.

What’s particularly appealing about wine as an investment is its low volatility. Compared to other assets like stocks or even real estate, the wine market tends to be less influenced by short-term economic fluctuations. Yes, wine prices can still experience highs and lows, but overall, they tend to appreciate steadily over time.

Another interesting aspect is that wine is a tangible asset. Unlike stocks or bonds, which exist only on paper, wine is something you can hold in your hands, admire, and, if you’re feeling generous, even drink. That’s part of the allure for many investors—there’s something satisfying about owning a physical product that has real value.

How Does Fine Wine Investment Work?

Let’s get into the nuts and bolts of how wine investment actually works. The basic idea is simple: you buy wine that’s both scarce and age-worthy, store it properly, and let time do its thing. As the wine ages, its value increases, and eventually, you sell it for a profit. It’s similar to buying a rare piece of art or a classic car, but in this case, you’re banking on the fact that great wine improves with age.

Now, some people prefer to physically own the bottles they invest in, storing them in their own cellars. Others, especially those without the space or conditions to store wine properly, choose to have their wine stored in professional facilities. Either way, the goal is the same: buy low (or at a reasonable price), hold onto it, and sell high.

One of the reasons wine has become such a popular investment in recent years is its strong historical performance. Over the last 15 years, fine wine has delivered an average annual return of 13.6%. That’s an impressive figure when you consider the relative stability of the market compared to other assets.

How to Invest in Wine for Beginners

How to Invest in Wine with Little Money

Investing in wine doesn’t have to be a game only for the wealthy, even though the image of wine investment can sometimes seem tied to rare bottles, sprawling cellars, and hefty price tags. But let me tell you, from my experience as a sommelier and someone who’s been in the wine world for years, you can absolutely start investing in wine with limited funds. It just requires a bit of strategy, knowledge, and patience.

Start Small with Affordable Wines

One of the most straightforward ways to invest in wine on a budget is to start by buying affordable, age-worthy wines. These are wines that don’t necessarily cost a fortune upfront but have the potential to appreciate in value over time. Look for regions and vintages that are still underrated. Wines from lesser-known appellations in regions like Bordeaux or the Rhône Valley can often be a fraction of the price of top-tier producers, but they’re still made with great care and have the potential to age beautifully.

For example, second labels from top Bordeaux producers or “village” level Burgundy wines offer incredible value. They come from the same regions, often made by the same hands, but don’t carry the hefty price tag of the Grand Cru wines. Another great tip is to look to regions that are on the rise, such as those in South America or Eastern Europe. These areas are producing some fantastic wines that are still under the radar, meaning you can invest without breaking the bank.

Consider Fractional Wine Investment Platforms

One of the best innovations I’ve seen in the wine world is the rise of fractional wine investment platforms. These platforms allow you to invest in fine wine by buying shares or “fractions” of a bottle or a collection, rather than needing to purchase the whole thing outright. It’s a fantastic way to get involved in wine investment without needing large sums of money upfront.

With these platforms, you don’t even have to worry about storage. The wine is usually kept in professional facilities, ensuring that it’s maintained in ideal conditions while it appreciates in value. This approach makes wine investment accessible to people with smaller budgets and allows you to diversify your investment by owning shares in multiple wines rather than putting all your money into one bottle.

Wine Investment Funds

Another option for wine enthusiasts with limited funds is to consider wine investment funds. These work similarly to mutual funds or ETFs in the stock market. You pool your money with other investors to invest in a collection of wines, and the fund managers—who are typically industry experts—handle the selection, purchasing, and selling of the wines. This means you can rely on their expertise without needing to know every detail about wine investing yourself.

While this might feel less personal, it’s an excellent way to get started without needing extensive wine knowledge or a large amount of capital. And, because these funds are managed by professionals, you can have some confidence in the strategy being used to grow your investment.

Look for Wines at Auction

Wine auctions might sound intimidating, but they’re actually a fantastic way to find deals if you know what you’re looking for. Many auction houses have lots that are more affordable, and sometimes you can pick up hidden gems for much less than their market value. My advice for auctions is to do your research beforeand—know the market prices of the wines you’re interested in, and set a budget for yourself so you don’t get caught up in bidding wars.

There are online auction platforms that cater specifically to wine, so you can participate from the comfort of your own home. This makes it more accessible and less intimidating than a traditional auction room.

Patience is Key

Wine investment is not a get-rich-quick scheme. It takes time for wines to appreciate in value, and it requires patience. Don’t rush to sell your wines too quickly—fine wine often reaches its peak value after several years of aging. The key is to hold onto your wines long enough to see their value increase, but not so long that they pass their prime drinking window.

Investing in wine with little money is completely doable, and it can be an incredibly rewarding experience. You don’t need a cellar full of first-growth Bordeaux or a six-figure bank account to get started. With a bit of research, patience, and some savvy investing, you can begin building a collection that grows in value over time, even if you’re starting with just a few dollars.

Best Wine Investment Companies

When it comes to wine investment, especially if you’re new to the game, one of the smartest moves you can make is working with a reputable wine investment company. They have the expertise, resources, and industry connections to guide you through the process, ensuring that your investment is smart and secure. As a sommelier, I’ve seen firsthand how much these companies can streamline the process and take some of the guesswork out of wine investing. Here are a few of the best wine investment companies to consider.

Cult Wines

Cult Wines is one of the biggest names in wine investment, and for good reason. They’ve been around since 2007 and have built a reputation as a trusted leader in the fine wine investment space. What I love about Cult Wines is their transparency—they provide detailed insights into the market, their investment strategies, and the performance of your portfolio.

They offer a range of services depending on your level of investment, from those just starting out to seasoned investors looking to expand their collections. You’ll have access to a dedicated portfolio manager who will guide you through the process, helping you build a diversified collection of wines with strong potential for appreciation. Cult Wines also takes care of the logistics—like storage and insurance—so you don’t have to worry about the details.

Vinovest

Vinovest is another standout in the wine investment industry, particularly for those who are newer to wine investing. They’ve really embraced technology, offering a sleek, user-friendly platform where you can easily invest in wine and track your portfolio’s performance. What’s great about Vinovest is that they offer investments at different levels, so you can start with a smaller amount of money and gradually build your portfolio over time.

Vinovest uses machine learning to analyze market data and make recommendations, but they also have a team of sommeliers and wine experts overseeing the process. This combination of technology and expertise makes it a solid option for both novice and seasoned investors. They also handle storage, insurance, and even the sale of your wines when the time comes, which makes it incredibly convenient.

WineCap

WineCap is another company that’s been gaining attention in the wine investment world. They focus on offering personalized wine investment advice, tailoring their recommendations to your specific goals and budget. What sets WineCap apart is their focus on education—they want their clients to not only invest but also understand the wine market and how to make informed decisions.

They offer portfolio management services as well as a wealth of market data and insights to help you stay informed about the wines you’re investing in. Like the other companies I’ve mentioned, WineCap also handles the logistics, ensuring that your wines are stored in optimal conditions and properly insured.

Berry Bros. & Rudd

If you’re looking for a company with deep roots in the wine industry, Berry Bros. & Rudd is an excellent choice. Founded in 1698, they’re one of the oldest wine merchants in the world, and they’ve been offering wine investment services for decades. What I love about Berry Bros. & Rudd is their unparalleled knowledge and expertise. They have strong relationships with top producers and access to some of the finest wines in the world.

Their investment services are tailored to more serious investors, but they do offer excellent educational resources for those looking to learn more about the world of wine investment. Their reputation and history in the industry make them a trusted partner for wine investors who want to work with a company that has a proven track record.

Wine Owners

Wine Owners is a UK-based wine investment company that offers a range of services, from portfolio management to storage and insurance. They have a user-friendly platform that allows you to track your wine portfolio, view market data, and even sell your wines through their marketplace when the time is right. What I appreciate about Wine Owners is their emphasis on data—they provide detailed market analysis and insights to help you make informed decisions about your investments.

Wine Owners also offers a social component, allowing you to connect with other wine investors and enthusiasts. This makes it a great option if you’re looking to learn from others and expand your knowledge of wine investment.

Best Wine Investment Platform

Investing in wine has come a long way in recent years, with the rise of online platforms making it more accessible than ever. Whether you’re a seasoned investor or just starting out, using the right platform can make a huge difference in your wine investment journey. Based on my experience as a sommelier and the knowledge I’ve gained from working in the industry, here are some of the best wine investment platforms you should consider.

Vinovest

Vinovest is easily one of the best wine investment platforms out there, especially for beginners. It’s intuitive, user-friendly, and makes wine investment feel approachable. When you sign up for Vinovest, you can start with as little as $1,000, which is a pretty low barrier to entry compared to other forms of investing. The platform uses a combination of machine learning and human expertise to help you build a wine portfolio that’s tailored to your investment goals.

Vinovest takes care of all the logistics for you—buying the wine, storing it in professional facilities, insuring it, and even selling it when the time is right. All you have to do is sit back and watch your investment grow. I also appreciate how transparent they are with their fees and how easy it is to track the performance of your portfolio through their online dashboard.

For anyone new to wine investment or just looking for a hassle-free experience, Vinovest is a fantastic option. They offer a range of plans depending on your investment level, and their customer support is excellent. Plus, they make it easy to sell your wines when you’re ready, which is a huge bonus in an industry where liquidity can sometimes be an issue.

Cult Wines

Another standout platform is Cult Wines. They’ve been a leader in the fine wine investment world for over a decade, and their online platform is incredibly comprehensive. What I like about Cult Wines is their focus on both data and personal service. When you sign up, you’re assigned a dedicated portfolio manager who helps guide you through the process of building a diversified wine portfolio. The platform also offers detailed market data, performance tracking, and insights to help you make informed decisions.

Cult Wines caters to both beginners and more experienced investors, offering a range of investment options depending on your budget and goals. They handle storage, insurance, and everything else on the logistical side, so you don’t have to worry about the technical aspects of wine investing.

What sets Cult Wines apart is their global reach and network. They have access to some of the best wines in the world and use their connections to source bottles that are hard to find elsewhere. For those serious about wine investing, Cult Wines is a top-notch platform that combines technology with a human touch.

WineCap

WineCap is another excellent wine investment platform that has been gaining traction recently. What I love about WineCap is their focus on education and transparency. They offer a wealth of information about the wines you’re investing in, and their platform is packed with market data and analysis to help you understand the value of your portfolio. This is particularly useful for investors who want to be more hands-on and learn about the intricacies of wine investment.

WineCap also offers personalized investment advice, tailoring their recommendations based on your specific goals and budget. Like the other platforms, they take care of storage, insurance, and the eventual sale of your wines, making the whole process seamless.

For investors who want to gain more knowledge about the wine market while building a portfolio, WineCap is an excellent choice. Their platform is easy to navigate, and their focus on data and education makes them stand out in the crowded wine investment space.

Liv-ex

Liv-ex is a bit different from the other platforms I’ve mentioned because it’s a global marketplace for fine wine trading rather than a traditional investment platform. However, it’s one of the best tools out there for serious investors who want to be more hands-on with their wine investments. Liv-ex provides detailed market data, real-time pricing, and a trading platform where you can buy and sell wines directly.

One of the biggest advantages of using Liv-ex is the access to market data. They provide in-depth analysis of the fine wine market, helping you understand trends and make informed investment decisions. It’s a platform that caters to more experienced investors, but it’s an invaluable resource if you’re serious about wine investing and want to take a more active role in managing your portfolio.

Best Wine Investment Apps

Wine investment has become more accessible than ever thanks to technology, and now you can manage your wine portfolio directly from your smartphone. As a sommelier who’s worked in the wine industry for years, I’ve seen how these apps have simplified the process and opened up wine investing to a much broader audience. Here are some of the best wine investment apps that can help you get started or take your wine investments to the next level.

Vinovest App

The Vinovest app is hands-down one of the best wine investment apps out there, especially for beginners. The app offers all the features of their desktop platform in a sleek, easy-to-use interface. Whether you’re just getting started or already have a portfolio, the app makes it incredibly simple to track your investments, view market data, and monitor your portfolio’s performance in real-time.

What I love about the Vinovest app is how intuitive it is. You don’t need to be a wine expert to use it—everything is laid out clearly, and you can get started with a minimal investment. The app also provides regular updates and insights into the wine market, helping you stay informed without feeling overwhelmed. For anyone looking for a hands-off, user-friendly way to invest in wine, the Vinovest app is a fantastic tool.

Vint

Vint is another wine investment app that’s worth checking out, especially if you’re interested in fractional wine investment. The app allows you to invest in collections of fine wine without needing to buy entire bottles. This makes it an excellent option for investors with smaller budgets who still want to participate in the wine market.

One of the key features of Vint is that they curate collections of investment-grade wines, and you can buy shares in these collections. This means you can diversify your wine investment without needing to spend a fortune upfront. The app is user-friendly and provides detailed information about the wines you’re investing in, including market trends and potential returns.

For those who want to invest in wine but don’t have the space or budget for full bottles, the Vint app is a great way to get started.

Vinfolio

Vinfolio is another app that’s perfect for wine enthusiasts who want to invest in fine wine. The app offers a range of services, from buying and selling wine to managing your wine portfolio. What sets Vinfolio apart is their focus on both investment and consumption. So, if you’re someone who enjoys drinking fine wine as much as investing in it, this app is a great choice.

The app allows you to track the value of your wine collection, view detailed market data, and even get recommendations for wines that match your investment goals. Vinfolio also offers professional storage solutions, ensuring that your wines are kept in optimal conditions as they age.

For investors who also want to enjoy their wines, Vinfolio strikes the perfect balance between consumption and investment.

CellarTracker

While not exclusively an investment app, CellarTracker is an essential tool for anyone serious about managing a wine collection. It’s the most comprehensive wine tracking app available, and it’s incredibly useful for keeping track of your wines, their current market value, and when they’re ready to drink.

If you’re building a wine portfolio for investment purposes, CellarTracker can help you stay organized and monitor the value of your collection. The app also provides tasting notes, reviews, and drinking windows, so you’ll always know when your wines are at their peak.

For those who want to combine investment with enjoyment, CellarTracker is an invaluable resource that helps you manage your collection like a pro.

FAQ about How to Invest in Wine

Final Thoughts

Wine investing can be a lucrative and rewarding investment option for collectors and investors. However, it requires a significant amount of knowledge and research to be successful. By educating yourself on the market, establishing a clear strategy, and purchasing high-quality wine with a clear provenance, you can build a valuable wine collection that will appreciate over time.

Wine investing is one of the most enjoyable and personal ways to diversify your portfolio. It’s not just about the financial returns – it’s about the thrill of discovering great wines, learning about producers and vintages, and being part of a centuries-old tradition. There’s a unique satisfaction in watching your collection grow and evolve, knowing that each bottle holds the potential to appreciate in both value and taste.

Remember, investing in wine takes time, research, and a genuine love for the craft. If you stay patient, informed, and passionate, wine can be an incredibly rewarding journey, both financially and personally. So go ahead, pour yourself a glass, and toast to your future as a wine investor. Cheers!